unemployment tax refund calculator

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Break Refund 2022.

. 1040EZ Tax Form Calculator. How to calculate your unemployment benefits tax refund. The American rescue plan contained a little-known clause the prevented the collection of taxes on unemployment benefits drawn in 2020.

Unemployment Income Rules for Tax Year 2021. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Get Your Max 2021 Tax Refund.

Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. Answering your unemployment income questions. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

The move was taken to help unemployed Americans during the pandemic but not all benefited from it initially. Ad File Your Federal State Tax Returns With TurboTax Get The Refund That You Deserve. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

In the latest batch of refunds announced in November however the average was 1189. 210 filer waited for stimmy 123 tax return and Unemployment refund. It is mainly intended for residents of the US.

The first thing we need to know is which exact tax bracket we fall into. This is an optional tax refund-related loan from MetaBank NA. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

The tax break is only for those who earned less than 150000 in adjusted gross income and for. Based on your projected tax withholding for the year we then show you your refund or. As of today i have all 5 in my back account it sucked waiting but now its all here i hope everyone here gets their money but now i need to say goodby to this sub.

Ad Calculate your tax refund and file your federal taxes for free. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or. Simply select your tax filing status and enter a few other details to estimate your total taxes.

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Loans are offered in amounts of 250 500 750 1250 or 3500.

2021 Tax Calculator Free Online. It is not your tax refund. Unemployment Tax Refund.

In total over 117 million refunds have. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Look at a federal tax table to see your amount of tax owed.

Start for free today. This Tax Return and Refund Estimator is currently based on 2021 tax year tax tables. Use this 2021 Tax Calculator to estimate your 2021 Taxes.

These two things will help us to ascertain exactly how much money or how much of a refund we will be owed. Unemployment income Tax calculator help. Choose TaxSlayer and get your maximum refund and 100 accuracy guaranteed.

The IRS is expected to continue working through the tax returns backlog for the rest of summer at least meaning that it could be some time. If you didnt have tax withheld from their unemployment payments or didnt have enough withheld in 2021 you may owe money to the IRS or get a smaller-than-expected tax refund. The difference between the tax you owe and the tax you owed when originally filing should be your refund line 24 on you 1040.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. You can include your unemployment income in our tax calculator to get an estimate of your tax liability or potential refund. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

So in order to follow along youll need two things. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Filing with us is as easy as using this calculator well do the hard work for you.

File Your Tax Returns With Confidence And Get Your Taxes Done Right With TurboTax. And is based on the tax brackets of 2021 and 2022. When Will I Get The Refund.

TaxSlayer is here for you. Before we jump to your questions you may want to see how your unemployment income will affect your taxes. Simply select your tax filing status and enter a few other details to estimate your total taxes.

Unemployment tax refund. Were here for more than calculating your estimated tax refund. Federal Income Tax Estimator.

If you recieved 10200 or more in unemployed subtract 10200 from your taxable income line 15. How To Calculate How Much Will Be Returned. The first phase included the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits.

To help offset your future tax liability you may voluntarily choose to have 10 of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service IRS. Your tax bracket and a simple calculator. As soon as new 2024 relevant tax data is released this tool will be updated.

Deleted 1 yr. Unemployment benefits count as taxable income the unemployment income federal tax exemption does not include unemployment income for 2021. Irs tax refund 2022 unemployment irs tax refund 2022 unemployment.

More complicated ones took longer to process. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. Calculating Your Unemployment Tax Break.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Timeline Here S When To Expect Yours

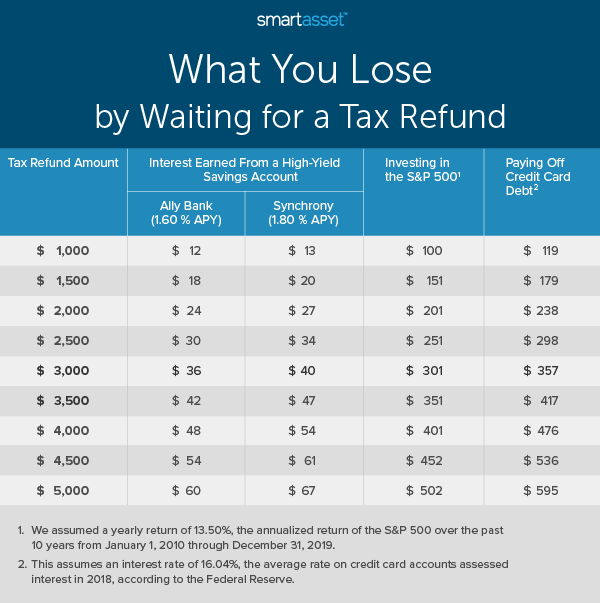

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Special Needs Trust 7 Frequently Asked Questions About Special Needs Trusts Tax Tax Consulting Tax Business Tax

Blue Springs Tax Preparation For Business Owners Your Tax Preparation Needs Are As Individual As You Are Alliance Financi Tax Attorney Tax Lawyer Tax Refund

Tax Refund Timeline Here S When To Expect Yours

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

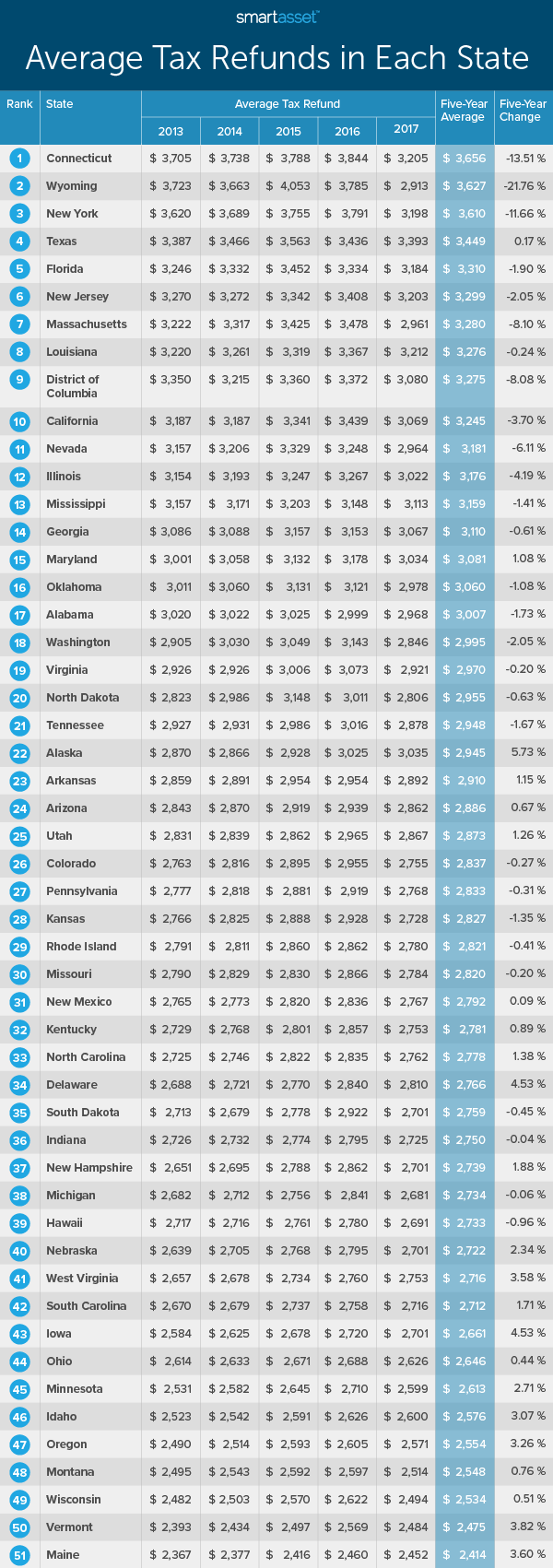

Here S The Average Irs Tax Refund Amount By State

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Tax Refund Delays Reasons Why Your Irs Money Hasn T Arrived Yet Cnet